For my dissertation I look at a fair amount of Saudi labor statistics, which have attracted a bit of media coverage of late – the General Authority for Statistics delayed the release of the Q3 2020 labor market report several times “to ensure that the data collected… are up to the standards GASTAT is committed to.”

Now that the data has been released (showing a slight drop in the unemployment rate, from 15.4% to 14.9%), I’ve compiled a quick overview of the last few years of statistics. Jobs creation has been a key metric of success for Saudi Arabia’s economic reforms (“SAUDI CROWN PRINCE’S LEGACY RESTS ON RISKY JOB REFORMS,” FT, England and Omran 2020) so it’s worth seeing what the numbers tell us.

That said, even at their best these statistics can be a bit… opaque. Saudi government agencies did not regularly publish a measure of unemployment rates until the 21st century, and changes in methodology make it hard to compared numbers over time. Most recently, in 2016, GASTAT transitioned from estimating the size of the labor force through surveys to measuring employment through the registration of employees with the General Organization for Social Insurance (private sector) and the Civil Service (mostly public sector, some state-owned enterprises. This means that current numbers are only comparable as far back as late 2016; other measures start appearing more recently.

Thoughts? There is certainly more I could go into here (wages by age, unemployment rates by age cohort, public vs private-sector employment by region) and maybe I’ll come back to this in the days ahead. For now, main takeaways seem to be:

- The bulk of gains in Saudi employment have accrued to

- Saudi women, especially those in clerical/sales positions

- Saudi men in higher-skill jobs

- Saudis living in Riyadh (and to a lesser extent, the Eastern Province)

- Saudis older than 30 (though there’s a chance this is just due to demographics)

- If departures by expatriates are translating into jobs for Saudis, it is at a fairly high “crude replacement rate” of anywhere from 10 to 20 expats-per-Saudi

- COVID-19 has scrambled the services sector (where most Saudis work) pretty hard; unclear how this will show up in the statistics in the long run (were people just moved off the books of a particular position at a particular company but still counted as “employed” by GASTAT?)

Expat Exodus, Limited Gains for Nationals

Taking Q4 of 2016 as our starting point, a net total of around 2 million expatriate workers have left Saudi Arabia in the intervening 3 years and 9 months (albeit a small net increase for expatriate women, chiefly in the private sector).

At the same time, the labor market has seen a net gain of around 200,000 Saudi employees in the same time period (military and security personnel are not included in statistics).

While Saudi men make up nearly 2/3 of Saudis employed overall (64%)…

Saudi women account for over 2/3 of jobs added in the past ~4 years.

Slower Jobs Growth for Younger Saudis

Next I look solely at the number of Saudi nationals employed to see how many of these new jobs have accrued to younger Saudis (given the government’s particular policy focus on youth unemployment). Broadly speaking, the number of employed Saudi men under 30 fell by over 100,000 over the past ~4 years, while the number of more mature employed men (aged 30 to 44) increased by slightly more than that.

The number of Saudi women working generally increased – by about 1% over the time period for those under 30 (~5,000 jobs added total), and by around 10% for those aged 30-45 (~50,000 jobs). [Not sure what’s happening with the 45+ crowd in both charts – numbers are up, but due to a sudden jump in 2020 for both men and women].

This does not look promising if the aim has been to boost youth employment – particularly the fact that fewer Saudi men under 30 seem to be employed than in 2016.

To be sure, the 2017 Population Characteristics Survey (also GASTAT) suggests that Saudi birth cohorts between the late 1990s and ~2005 tended to be smaller than those immediately before and after (perhaps due to the economic downturn prior to the 2003-2014 commodities boom) which might explain some of the dropoff.

Yet even though unemployment rates are down vs Q4 2016 for most age cohorts, youth unemployment (here, for male Saudis) is still much higher than for older Saudis.

Job Classes & Impact of COVID

For Saudi men, the pre-pandemic years saw something of a polarization of jobs – fewer jobs in (typically) lower-skilled positions in services and basic industries, more high-skill technician and specialist jobs (with a slight uptick in managerial-level positions).

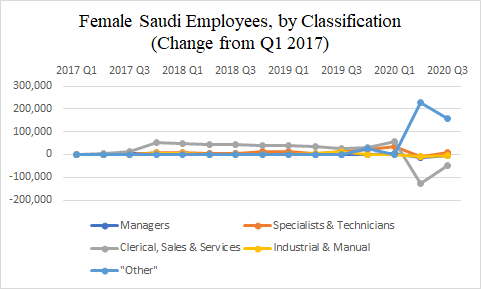

Saudi women continued to make gains in clerical positions as well as sales & services, albeit with initial 2017 gains eroding over the course of 2018 and 2019 (i.e. once VAT was imposed and consumer spending generally dropped, though correlation =/= causation etc.).

The COVID-19 pandemic seems to have scrambled much of this, however. Several hundred thousand Saudi men and women suddenly move into the job classification “other” for Q2 of 2020. This move offsets losses among clerical, sales & services staff – i.e. the positions where the bulk of Saudi men (55% in Q1 2020) and women (64% in Q1 2020) are employed – in aggregate “employment” numbers but is visible in comparing the size of this “other” category to the names job classification categories.

If this “other” represents some kind of paycheck protection program for Saudi employees as business closed down, then nearly 25% of the Saudi-citizen workforce as of Q1 2020 was on some kind of furlough at the end of Q2 2020 – albeit with many of these individuals returning to work in Q3 of 2020 (12% of Saudi male employees, 7% of Saudi women in Q1 2020 were still in the “other” category).

Geographic Concentration

I’ve written elsewhere about how recent economic changes might be exacerbating geographic inequality in Saudi Arabia. This shows up pretty clearly in the employment figures – only Riyadh has seen noticeable growth in Saudi male employment in the past 4 years (though again, these numbers don’t take into account the security services or the armed forces). For male employment, several regions have only recently returned to their c. late 2016 levels from significantly lower numbers of employed men – exactly how, during the pandemic, I’m not sure.

On a more positive note, the number of employed Saudi women has grown in just about every region of the Kingdom – though again, the growth in opportunities in Riyadh (and to a lesser extent, the Eastern Province) outstrips much of the rest of Saudi Arabia.

Wages

Not much going on with respect to wages, which have been pretty stable over the past 4 years. Maybe a slight narrowing in the wage gaps between men and women in the private sector at first (which could be caused by any number of things), but widening again in the past two quarters.

The significant wage gap between the public and private sector has gone nowhere, reflecting the fixed higher wages of most public-sector jobs that form a fairly strong incentive for Saudi job-seekers to hold out for higher-wage positions in the government bureaucracy.

Leave a comment